The last decade has seen the concept of impact investing gain significant recognition among foundations and investors alike. This approach involves deploying capital strategically to generate social impact and financial returns. In theory, investors can support companies with a strong social conscience, and foundations are able to leverage their entire balance sheets, unlocking additional capital to make a difference in the community. This article delves into the core ideas and key aspects of impact investing, exploring its challenges, and highlighting how it can effectively drive positive change in society. (Sherman & Olazabal, 2022)

What is Impact Investing?

The terms impact investing and ESG (environmental, social, and governance) investing are often used interchangeably. While both strategies aim to align investments with the mission and values of the investing body, impact investing goes a step further by explicitly aiming to drive positive social or environmental impact alongside financial returns. (Sherman & Olazabal, 2022)

Definitions of impact investing are somewhat varied. For example, the Mulago Foundation (2012) defines impact investing in a manner which excludes organizations that provide competitive market returns:

“[I]mpact investing is the practice of putting money – loans or equity – into impact-focused organizations, while expecting less than market rate of return. Investments that provide big returns don’t count: the market will take care of those, and we don’t need conferences to get people to put money into them."

On the other hand, Meredith Lorenz Heimburger’s (2022) definition is more akin to ESG investing. For example, she has invested in green energy batteries, which is quite different in terms of profit generation when compared to investing in an organization that provides free education to children in low-income areas. However, she does raise the point of how invested capital can complement philanthropic capital:

"Supporting foodbanks is important, but it does not address the root cause of food insecurity. Food banks feed an estimated one in seven Americans, with Black individuals three times more likely to face food insecurity than white households. Impact investing provides a unique opportunity to address the gaps in economic equality and wealth creation – the issues that often cause food insecurity in the first place… Black entrepreneurs receive less than 2% of venture funding [and] Black business owners are denied loans nearly twice as often as white business owners. Access to capital and credit are critical to building businesses which are in turn critical to increasing wealth in communities. Impact investors can invest directly in minority-led investment funds to increase the flow of capital to historically undercapitalized entrepreneurs… When it comes to issues of equity and access, impact investing can provide an opportunity to utilize investment capital instead of or alongside philanthropic capital to address root causes."

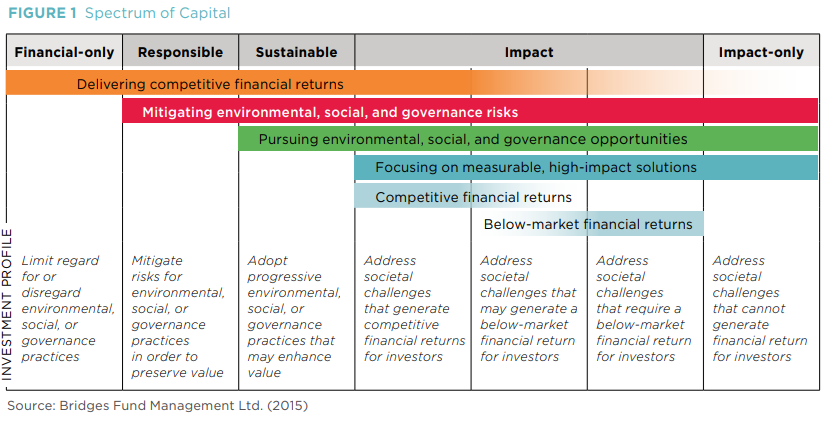

This chart from Sherman and Olazabal (2022) shows the relationship between level of impact and financial rate of return in investments:

Challenges & Criticisms

Impact investing, with its alluring promise of positive social impact combined with financial gains, has had a profound influence on philanthropy. But it has its fair share of challenges and criticisms, which need to be addressed for it to be implemented effectively.

One fundamental issue revolves around how social enterprises that employ revenue-based models often encounter unrealistic economic expectations. Furthermore, impact investing can create a misleading belief that traditional business models alone can address substantial social and environmental challenges. It is crucial to recognize that not all solutions catering to the needs of the impoverished will yield significant financial returns. (Starr (P1), 2012)

Moreover, impact investing can sometimes lead organizations astray from their core mission as they strive to meet investor demands. There can only be one true bottom line and it's either impact or profit. When not implemented correctly, impact investing can even cause harm. For instance, organizations may deviate from their target population to cater to those who can offer greater financial gains because of pressures from investors. (Hattendorf, 2012)

Another major issue with impact investing lies not in the concept itself but in its execution thus far. Often, initiatives fail to resonate with the target population, and the measurement of the impact is poorly executed. Unlike financial markets, which efficiently allocate money to profitable firms, there is no equivalent market for impact. While there is a demand for impact investments that generate market returns and deliver genuine social impact, such opportunities are not yet available on a large scale, underscoring the importance of clarity and effective impact measurement. (Bildner, 2023)

Solutions

One potential solution to the impact investing conundrum is for investors to determine the desired level of return and search for firms that offer the most impact at that expected rate of return. Alternatively, investors can decide on an expected level of impact and seek out firms that provide it along with the best rate of return. Regardless of the approach, consistent impact measurement and reporting are crucial. (Starr (P3), 2012)

To make a significant difference, it is crucial to move beyond scattered investments and instead focus on clustering businesses, building value chains, and fostering competition. This approach requires effective coordination of different forms of capital to achieve substantial and scalable impact. Impact investing should be integrated into a broader effort that encompasses business capital, real estate capital, nonprofit funding, and community development funding. By coordinating these various forms of capital with realistic economic expectations, we can effectively tackle systemic issues and ensure long-term success. (Bildner, 2023)

The Role of Organizational Structures & Standards (Sherman & Olazabal, 2022)

Over the past 15 years, significant groundwork has been laid to empower foundations in maximizing their positive influence on people and the planet by utilizing their assets and financial resources effectively. Notably, the establishment of the Global Impact Investing Network (GIIN) in 2008 has played a pivotal role in shaping and informing the impact investing field, providing a solid foundation for progress.

One of the key contributions of the GIIN is the sponsorship of the IRIS+ system, which equips investors with a comprehensive toolkit to measure and manage impacts across various sectors and themes, including, but not limited to, racial and gender equity. By leveraging these tools, foundations can assess their performance and make informed decisions to enhance their social and environmental outcomes.

Moreover, frameworks such as the United Nations' Sustainable Development Goals Impact Standards have emerged to support businesses and investors in integrating sustainability and the SDGs into their internal management systems and decision-making practices. These standards offer detailed guidelines that enable organizations to align their strategies with global sustainability objectives, providing a roadmap for responsible and impactful operations.

Additionally, the International Finance Corp., an institution affiliated with the World Bank, has developed a set of impact management operating principles. These principles outline the essential features of effectively managing impact investments. By adhering to these principles, foundations can ensure that their investments generate meaningful and measurable positive effects, contributing to sustainable development on a global scale.

Collectively, these tools form a solid base for foundations to navigate the realm of impact investing, enabling them to utilize their resources in a manner that creates a lasting and positive impact on both people and the planet.

In summary, impact investing is not perfect and comes with challenges and drawbacks, but it still presents an exciting opportunity for foundations and investors to generate positive change while achieving financial returns. By adopting a deliberate and coordinated strategy that aligns capital with social and environmental objectives, impact investors have the power to tackle societal problems, contribute to a more equitable and sustainable future, and drive lasting impact.Bibliography

Bildner, J. (2023) Impact Investing Can’t Deliver by Chasing Market Returns. Retrieved from https://ssir.org/articles/entry/impact_investing_cant_deliver_by_chasing_market_returns?utm_source=Enews&utm_medium=Email&utm_campaign=SSIR_Now

Hattendorf, L. (2012) The Trouble with Impact Investing Part 2. Retrieved from https://ssir.org/articles/entry/the_trouble_with_impact_investing_part_2

Lorenz Heimburger, Meredith. (2022) Impact Investing, and What I wish I Knew When I Started. Retrieved from https://www.ncfp.org/2022/08/11/impact-investing-and-what-i-wish-i-knew-when-i-started/

Sherman, J., & Olazabal, V. (2022). Using Foundation Capital for Good: Opportunities in the Balance Sheet. The Foundation Review, 14(4), 4.

Starr, K. (2012). The trouble with impact investing: P1 (SSIR). Retrieved from https://ssir.org/articles/entry/the_trouble_with_impact_investing_part_1#

Starr, K. (2012). The trouble with impact investing: P3 (SSIR) Retrieved from https://ssir.org/articles/entry/the_trouble_with_impact_investing_p